Labor Rates

Explanation of Labor Rates and instructions to edit them.

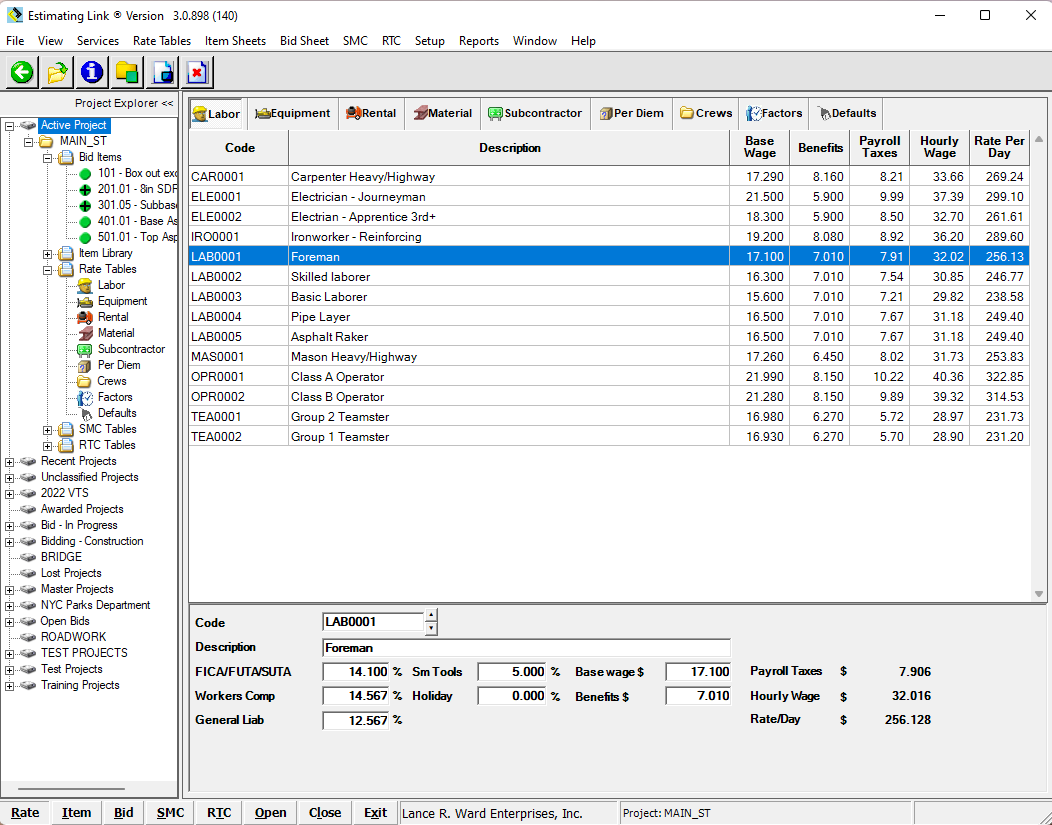

Labor Rates

The labor section of the Rate Tables is for entering labor classifications such as on a

prevailing wage schedule. These would be things such as “Class A Operator”, “Foreman”,

etc. However, depending on your company, this could also be entered by using an Employee

name if you choose.

The following fields are specific to the Labor tab of the Rate Tables:

| Code | Labor Rate Code - unique code within labor cost type. May consist of letters and numbers, and be up to 9 characters in length. |

|

Description |

Labor Rate Description - May consist of letters and numbers and be up to 60 characters in length. |

| FICA/FUTA/SUTA | This is the combined percentage of these three taxes. Entered as a percentage of the Base Wage. |

| Workers Comp | Entered as a percentage of the Base Wage. |

| General Liability | Entered as a percentage of the Base Wage. |

|

Other 1 Other 2 |

These can be used to cover holiday time, or other miscellaneous labor costs. Entered as a percentage of the Base Wage. |

| Base Wage | The base hourly wage. |

| Benefits | The benefits per hour. |

| Payroll Taxes |

This is calculated by taking the sum of all the percentage Please note that payroll taxes are not applied to the benefits. |

| Hourly Wage | This is calculated as Payroll Taxes + Base Wage + Benefits. |

| Rate/Day |

This is calculated as the Hourly Wage multiplied by 8 hours.

|

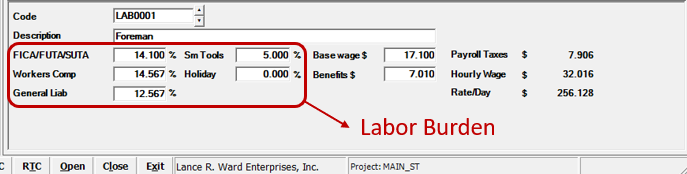

Labor Burden

Estimating Link gives you 5 fields for your labor burden:

The defaults for the Labor Burden percentages are FICA/FUTA/SUTA, Workers Comp, General Liab, Other 1 and other 2. You can change the field titles to suit your needs and you can use one or all of the fields.

Below is an explanation of the Labor Burdens that are loaded when you install Estimating Link's demo project Main St. The following is for demonstration purposes only. You should do your own research to discover your labor burden.

FICA/FUTA/SUTA

- FICA - FICA stands for the Federal Insurance Contributions Act. U.S. federal payroll tax paid by employers on employee wages. FICA generally includes: social security, Medicare and Medicare surtax.

- FUTA - FUTA stands for Federal Unemployment Tax Act. U.S. federal payroll tax paid by employers on behalf of their employees.

- SUTA - SUTA stands for State Unemployment Tax Act. State Payroll tax paid by employers on behalf of their employees to their state unemployment fund. SUTA rates vary by state.

FUTA & SUTA - In the event that these taxes are only paid up to a certain amount of the employees wages, some Estimating Link customers will add the full percentage to the Labor Rate regardless of whether they still owe on it or not.

Worker's Comp - Stands for Workers' Compensation Insurance. This insurance helps protect your employees if they get a work-related injury or illness. Rates vary but you can obtain yours by contacting your Worker's Comp agent.

General Liab - Stands for General Liability Insurance. This insurance helps protect your actual business. Rates vary but you can obtain yours by contacting your General Liability agent.

Other 1 and Other 2.- In the above example, we have labeled Other 1 as Sm Tools which stands for Small Tools. Many customers use small tools here because they see a linear relationship between how many laborers are on a job and how many small tools are lost.

- In the above example, we have labeled Other 2 as Holidays. Many customers use this to account for employee holidays and/or inclement weather.

Edit Labor Rate Labels

If you would like to edit your Labor Burden in Estimating Link, you can do so by going to Setup > Options:

The CLI Preferences window will now be displayed. On the Company tab, select which company you'd like to edit the Labor Burden for (by using the down arrow to display your companies) and then click Edit:

The Edit Company window will now be displayed. You can change your Labor Rate Labels here: